Property Analytics uses a cross-sectional factor-based approach to analyse the London real estate market, similar to those widely used in equity market analysis. This methodology allows us to decompose property returns into specific factors that drive market prices.

Factor Model Development

Our model was developed through rigorous statistical analysis of London property transaction data from 1995. We employed multiple regression techniques to identify the key factors that consistently explain variations in property prices across different market cycles.

A Cross-sectional model

Decomposing returns into factors can be done in mainly three ways: a purely statistical approach, time-series regression, and cross-sectional regression. The first one is hard to interpret, and the second one requires knowing the factor returns a priori. The third one is the most powerful and therefore widely used for stocks. All it requires is knowing the characteristics of each property and regressing the prices on those to derive the factor returns. Fortunately, this is very easy for properties where we can use, for example, the number of rooms, but it's somewhat harder for stocks.

Mathematical Model

Our factor model can be expressed as the following equation:

\begin{multline}

\begin{split}

\log P_t & = \log P^0_t + \sum^F_i{\beta_{t}^i X_t^i } \\

r & = \log P_t - \log P_{t-1} = r^0_t + \sum^F_i r^i_t\\

r^0_t & = \log P^0_t - \log P^0_{t-1} \\

\sum^F_i r^i_t & = \sum^F_i \left( \beta_{t}^i X^i - \beta_{t-1}^i X^i_{t-1} \right) \\

\end{split}

\end{multline}

where Pt is the price of property at time t, βti are the factor returns for a given distribution, Xti are the factor distributions, rt0 is the baseline returns, and rti are the factor returns.

Factor Selection Process

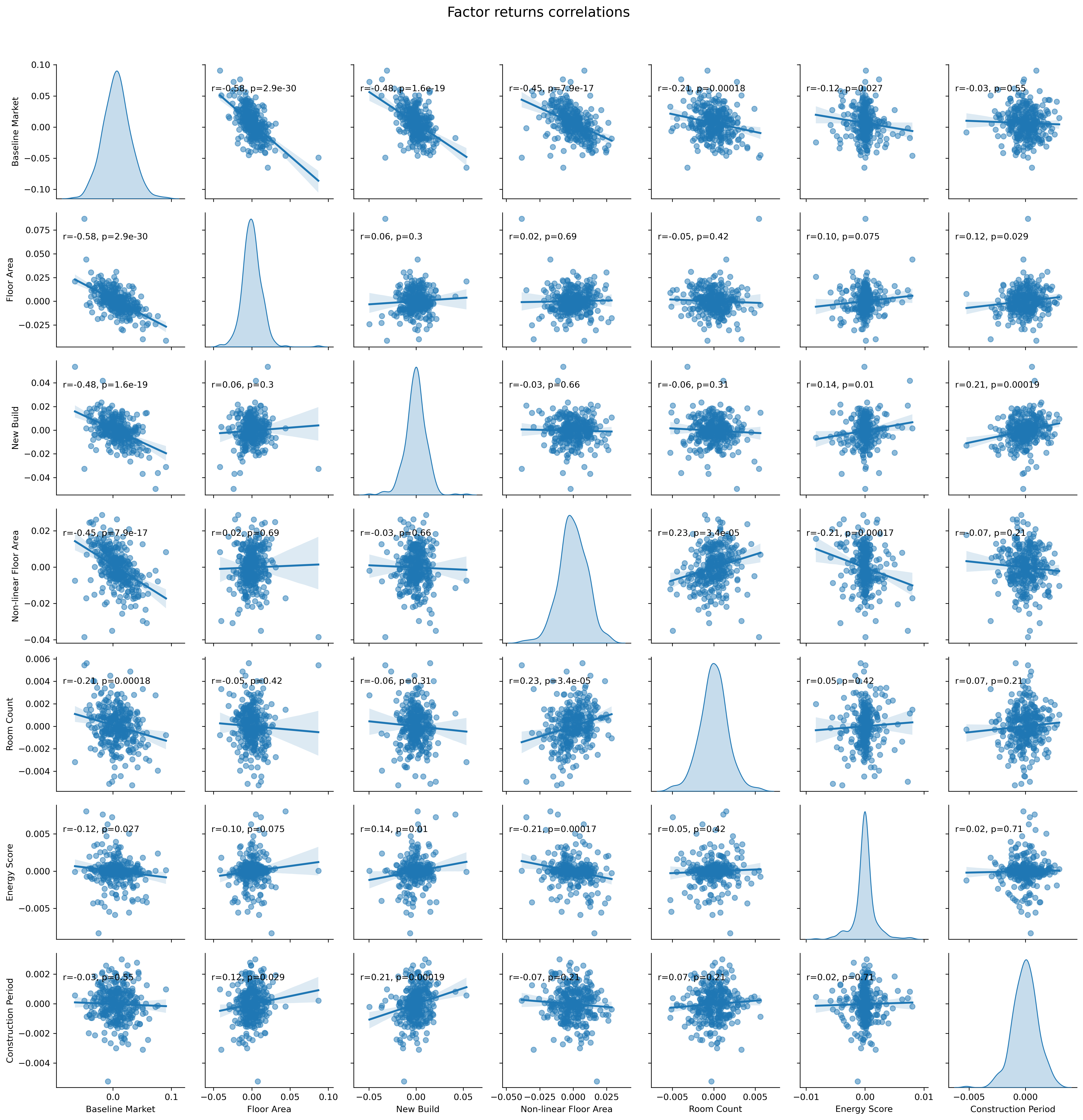

We started with a comprehensive set of potential factors and systematically eliminated those with low explanatory power or high correlation with other factors. The final model includes 7 factors that collectively provide a robust framework for understanding London property prices:

- Baseline market return

- Total floor area

- New build premium

- Non-linear floor area

- Number of habitable rooms

- Energy efficiency

- Construction period

Model Validation

We validate our model using rigorous statistical tests, like ratio between residuals and factor returns, low factor cross-correlations, and low autocorrelations. We also do out-of-sample testing, comparing its predictions against actual market transactions.